Funding 401ks and roth iras worksheet answers pdf – Welcome to the ultimate guide to funding 401ks and Roth IRAs, your essential resource for securing your financial future. This comprehensive worksheet answers PDF provides everything you need to know about these powerful retirement savings vehicles, empowering you to make informed decisions and maximize your savings potential.

Within this guide, you’ll discover the intricacies of 401ks and Roth IRAs, their unique benefits, and the strategies to optimize your contributions. Whether you’re a seasoned investor or just starting your retirement planning journey, this worksheet will serve as your roadmap to financial security.

Funding 401ks

401ks are retirement savings plans offered by employers. They allow employees to save money on a tax-advantaged basis, meaning that the money grows tax-free until it is withdrawn in retirement. There are two main types of 401ks: traditional and Roth.

Traditional 401ks, Funding 401ks and roth iras worksheet answers pdf

- Contributions are made pre-tax, reducing your current taxable income.

- Earnings grow tax-free until withdrawn in retirement.

- Withdrawals in retirement are taxed as ordinary income.

Roth 401ks

- Contributions are made after-tax, so you do not get a current tax deduction.

- Earnings grow tax-free and are not taxed when withdrawn in retirement.

- There are income limits for Roth 401k contributions.

Funding Roth IRAs

Roth IRAs are individual retirement accounts that allow individuals to save for retirement on a tax-advantaged basis. Like 401ks, there are two main types of Roth IRAs: traditional and Roth.

Traditional Roth IRAs

- Contributions are made pre-tax, reducing your current taxable income.

- Earnings grow tax-free until withdrawn in retirement.

- Withdrawals in retirement are taxed as ordinary income.

Roth Roth IRAs

- Contributions are made after-tax, so you do not get a current tax deduction.

- Earnings grow tax-free and are not taxed when withdrawn in retirement.

- There are income limits for Roth IRA contributions.

Questions and Answers: Funding 401ks And Roth Iras Worksheet Answers Pdf

What is the difference between a 401k and a Roth IRA?

401ks are employer-sponsored retirement plans that offer tax-deferred contributions, while Roth IRAs are individual retirement accounts that offer tax-free withdrawals in retirement.

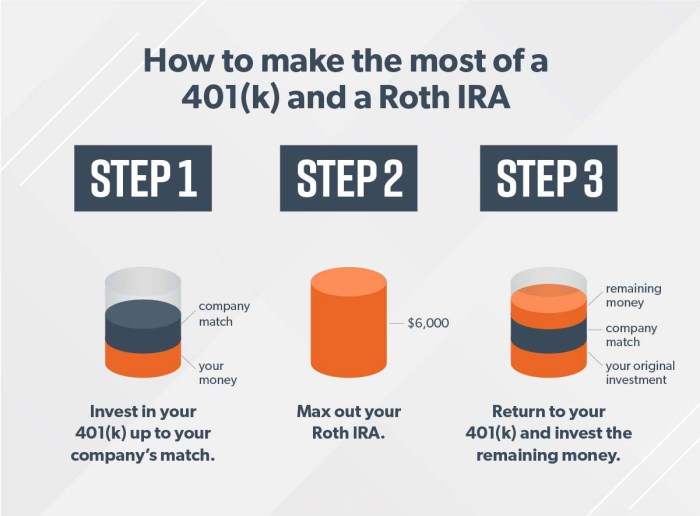

What are the contribution limits for 401ks and Roth IRAs?

For 2023, the contribution limit for 401ks is $22,500 (plus a catch-up contribution limit of $7,500 for those aged 50 and older), and the contribution limit for Roth IRAs is $6,500 (plus a catch-up contribution limit of $1,000 for those aged 50 and older).

When should I start funding my retirement accounts?

The sooner you start saving for retirement, the more time your money has to grow. Ideally, you should start contributing to your retirement accounts as early as possible.